On the other hand, there is no other public report that covers the central bank segment of the forex market as comprehensively as the COFER report does. Speculation about the death of the USD, for example, can easily be checked by referencing COFER data. It is, in short, a highly-valuable piece of data, the interpretation of which is, to an extent, subject to the commentator’s bias. Japan’s holdings of USD-denominated assets are expressed in USD, and they don’t change with the YEN-USD exchange rate. But Japan’s holdings of EUR-denominated assets are translated into USD at the EUR-USD exchange rate at the time. So the magnitude of Japan’s holdings of EUR-assets, expressed in USD, fluctuates with the EUR-USD exchange rate, even if Japan’s holdings don’t change.

The ratio of reporting central banks to non-reporting banks is highest for Europe and the Western Hemisphere. Reporters are recommended to use end-of-period market exchange rates beaxy exchange review to convert their reserves denominated in non-U.S. By the 1990s, with inflation on decline for a decade, confidence returned, and central banks loaded up on dollar-denominated assets again, until the euro came along, which combined the major European reserve currencies into one, making it a solid alternative to the dollar. The share of euro holdings in the allocated reserves decreased to 19.83 percent from 20.03 percent in 2024Q3. However, if the exchange rates had not moved, the euro share would have increased by 0.71 percentage point (p.p.).

- The report only provides aggregated data on the total reserves of all reporting central banks, and can be skewed in consequence of factors affecting a limited number of central banks.

- It’s a central bank “reserve asset.” So it doesn’t really fit into this discussion of foreign exchange reserves.

- The US dollar, still the #1 reserve currency held by central banks, keeps losing share in bits and pieces ever so slowly against a mix of other reserve currencies as central banks diversify their holdings of dollar-denominated assets to assets denominated in other currencies.

- The share of euro holdings in the allocated reserves decreased to 19.83 percent from 20.03 percent in 2024Q3.

First, the currency composition of each central bank is confidential. The report only provides aggregated data on the total reserves of all reporting central banks, and can be skewed in consequence of factors affecting a limited number of central banks. Second, since information is submitted xm group review to the COFER report on a voluntary basis, the data cannot be used as a random sample of central bank reserves.

Assessing Central Bank Reserves for Forex Profits: Reading the COFER Report

The share of USD-denominated foreign exchange reserves – assets that central banks other than the Fed hold that are denominated in USD – ticked down to 58.2% of total exchange reserves in Q2, the lowest share since 1995, according to the IMF’s new COFER data. The share of Chinese renminbi holdings in the allocated reserves was 2.18—unchanged from the previous quarter. Dollar dominance—the outsized role of the US dollar in the world economy—has been brought into focus recently as the robustness of the US economy, tighter monetary policy and heightened geopolitical risk have contributed to a higher greenback valuation. At the same time, economic fragmentation and the potential reorganization of global economic and financial activity into separate, nonoverlapping blocs could encourage some countries to use and hold other international and reserve currencies. Holdings in currencies other than USD are translated into USD at the exchange rate at the time.

The chart shows the share of the USD at year end except in 2024, for which we use the Q2 figure. Real Effective Exchange Rates for February 2025 were released on March 31, 2025.

Strikingly, the reduced role of the US dollar over the last two decades has not been matched by increases in the shares of the other “big four” currencies—the euro, yen, and pound. Rather, it has been accompanied by a rise in the share of what we have called nontraditional reserve currencies, including the Australian dollar, Canadian dollar, Chinese renminbi, South Korean won, Singaporean dollar, and the Nordic currencies. The most recent data extend this trend, which we had pointed out in an earlier IMF paper and blog.

The rise of the “nontraditional reserve currencies.”

At the same time, statistical tests do not indicate an accelerating decline in the dollar’s reserve share, contrary to claims that US financial sanctions have accelerated movement away from the greenback. To be sure, it is possible, as some have argued, that the same countries that are seeking to move away from holding dollars for geopolitical reasons do not report information on the composition of their reserve portfolios to COFER. Note, however, that the 149 reporting economies make up as much as 93 percent of global FX reserves. In other words, non-reporters are only a very small share of global reserves. The US dollar, still the #1 reserve currency held by central banks, keeps losing share in bits and pieces ever so slowly against a mix of other reserve currencies as central banks diversify their holdings of dollar-denominated assets to assets denominated in other currencies. COFER data are reported to the IMF on a voluntary and confidential basis.At present, there are 146 reporters, consisting of IMF member countries, anumber of non-member countries/economies, and other entities holdingforeign exchange reserves.

By examining the growth of overall forex reserves, we can gain an idea on the dynamism of global trade, and the growth rate of global imbalances as international claims increase with rising central bank reserves. One can regard each dollar in a central bank’s coffers as a claim on another nation’s economy, and the larger these claims are, the greater international imbalances must be. This is a consequence of the fact that, since international trade is mostly conducted in U.S. dollars, central banks end up with an excess of the U.S. currency, but prefer to reallocate a proportion of reserves to other currencies for diversification purposes. Although COFER is a very valuable tool for forex analysis, it is usefulness is limited by a number of factors.

Excluded are assets denominated in a central bank’s local currency, such as the Fed’s holdings of Treasury securities, and the ECB’s holdings of euro-denominated assets. These US-dollar denominated assets include US Treasury securities, US agency securities, US government-backed MBS, US corporate bonds, even US stocks, held by central banks other than the Fed. The share of other currencies in the allocated reserves (i.e., those excluding the US dollar, the euro, and the renminbi) decreased to 20.19 percent in 2024Q4 from 20.50 percent in 2024Q3, which was mainly attributed to their depreciation against the US dollar. This table provides a breakdown of the currency composition of official foreign exchange reserves held by countries around the world. The main disadvantage of the COFER report is that its coverage is weakest for Asia and Middle East/Africa, where exporter nations with the largest forex reserves tend to be clustered. Another problem is that, although coverage of currencies like the Euro or the USD is very good, information relating to reserve items like gold is not a part of the data breakdown.

List of Reporters

These factors may lie behind the further accumulation of gold by a number of emerging market central banks. Before making too much of this trend, however, it is important to recall that gold as a share of reserves still remains historically low. In dollar terms, central banks held foreign exchange reserves in all currencies of $12.35 trillion in Q2. Of this amount, holdings of USD-denominated assets dipped to $6.68 trillion.

- By examining the growth of overall forex reserves, we can gain an idea on the dynamism of global trade, and the growth rate of global imbalances as international claims increase with rising central bank reserves.

- Central banks have not been “dumping” their dollar-assets – in dollar amounts, their dollar-holdings haven’t changed much and are not far off the peak in 2021.

- Monetary gold is not covered in the foreign exchange reserves reported in COFER, but gold is part of reserves assets, which is a broader concept than that of COFER.

- Note, however, that the 149 reporting economies make up as much as 93 percent of global FX reserves.

- It is, in short, a highly-valuable piece of data, the interpretation of which is, to an extent, subject to the commentator’s bias.

Gold has re-emerged as a favored central bank reserve asset.

Taking a longer view, over the last two decades, the fact that the value of the US dollar has been broadly unchanged, while the US dollar’s share of global reserves has declined, indicates that central banks have indeed been shifting gradually away from the dollar. Some have suggested that what we have characterized as an ongoing decline in dollar holdings and rise in the reserve share of nontraditional currencies in fact reflects the behavior of a handful of large reserve holders. But when we exclude Russia and Switzerland from the COFER aggregate, using data published by their central banks from 2007 to 2021, we find little change in the overall trend. Recent data from the IMF’s Currency Composition of Official Foreign Exchange Reserves (COFER) point to an ongoing gradual decline in the dollar’s share of allocated foreign reserves of central banks and governments.

IMF reports and publications by country

So the exchange rates between the USD and other reserve currencies change the magnitude of the non-USD assets – but not of the USD-assets. Central banks have not been “dumping” their dollar-assets – in dollar amounts, their dollar-holdings haven’t changed much and are not far off the peak in 2021. But as overall foreign exchange reserves grow, they’re taking on assets denominated in many alternative currencies, and the dollar’s share of the total declines.

If this pace continues, the dollar’s share will kiss 50% in 10 years. The list of reporters includes the names of participating countries/economies that have agreed to have their names disclosed as COFER reporters. IMF Data is known for its high standard of quality and methodological consistency.

With over 50 datasets updated regularly, you always have access to the latest global economic trends and forecasts as well as trusted data for cross country research and analysis. The euro is the perennial #2, with a share that has for years been stuck at around 20%. BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why westernfx review it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Thisfollowed the Board decision to include RMB in the Special Drawing Right(SDR) basket of currencies as a fifth currency along with the U.S. dollar,the euro, Japanese yen, and pound sterling, effective October 1, 2016. When the IMF added the RMB to its basket of currencies backing the Special Drawing Rights (SDR) in 2016, the currency was seen as the coming threat to the dominance of the USD as global reserve currency. China is the second largest economy in the world, and it makes sense that it would have a major reserve currency. The long view back to the 1960s shows that the USD’s share of global reserve currencies was a lot lower in the 1970s and 1980s. The share collapsed from 85% in 1977 to 46% in 1991, as inflation had exploded in the US in the 1970s and into the 1980s, and the world lost confidence in the Fed’s willingness to get this inflation under control. You may continue to access the retiring system at legacydata.imf.org until May 31, 2025.

“Other currencies” refer to all currencies other than those that are separately identified in COFER data reporting. There is no breakdown of “other currencies” in COFER reporting, so individual currencies included in “other currencies” are indistinguishable. In sum, the international monetary and reserve system continues to evolve. The patterns we highlighted earlier—very gradual movement away from dollar dominance, and a rising role for the nontraditional currencies of small, open, well-managed economies, enabled by new digital trading technologies—remain intact. On February 26, 2016, theIMF Executive Board agreed to modify the COFER surveyto allow separate identification of the RMB effective October 1, 2016.

This recent trend is all the more striking given the dollar’s strength, which indicates that private investors have moved into dollar-denominated assets. At the same time, this observation is a reminder that exchange rate fluctuations can have an independent impact on the currency composition of central bank reserve portfolios. Changes in the relative values of different government securities, reflecting movements in interest rates, can similarly have an impact, although this effect will tend to be smaller, insofar as major currency bond yields generally move together. In any event, these valuation effects only reinforce the overall trend.

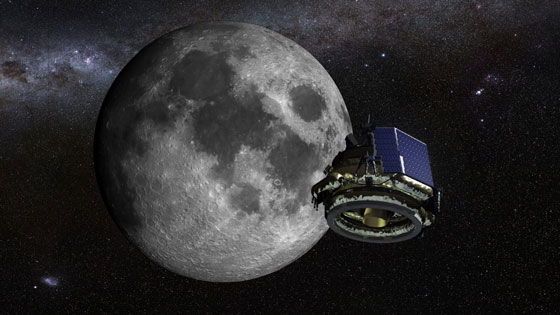

Moon Express (MoonEx), the host of the next Celestis lunar memorial spaceflight, has announced that it will provide $1.5M in private funding for NASA-selected, lunar science payloads to fly to the Moon — including a payload that will fly along with the Celestis participants on board

Moon Express (MoonEx), the host of the next Celestis lunar memorial spaceflight, has announced that it will provide $1.5M in private funding for NASA-selected, lunar science payloads to fly to the Moon — including a payload that will fly along with the Celestis participants on board